Get our independent lab tests, expert reviews and honest advice.

CHOICE calls on government to regulate buy now, pay later industry

Need to know

- Research by CHOICE and other consumer advocates shows that buy now, pay later products exploit loopholes in Australia's credit law to sell people into unaffordable debt

- In a 2022 national survey, we found that one in four buy now, pay later customers use these platforms for essential products or services

- Buy now, pay later products can also be misused as a tool of coercive control and financial abuse in family violence situations

In December last year CHOICE was one of 22 organisations that signed on to a joint submission to the federal government calling for the regulation of buy now, pay later (BNPL) lending products.

The submission makes the case that BNPL products “exploit loopholes in Australia’s credit law to sell people into unaffordable debt” and that these unregulated players in the credit industry are “causing serious economic and social harm to people, families and households across the country”.

As far as CHOICE and our allied organisation are concerned “these harms far outweigh the benefits BNPL brings to the economy”.

What we’re calling for

We’re calling for BNPL products to be regulated like any other lending product under the Credit Act, which mandates thorough safe lending checks, robust hardship support for those who can’t make a payment on time, and other consumer protections that buy now, pay later lenders often do not provide.

Buy now, pay later products target and exploit the most vulnerable people in our community. It’s purely a business exercise for the companies involved

CHOICE survey respondent

While BNPL businesses claim they’re not lenders in the traditional sense, the fact remains that they make money available to clients who then have to pay it back with extra costs tacked on. Whether it’s called interest or fees is a matter of semantics for the end-user. These clients are often financially vulnerable people for whom further debt can make matters worse.

Community support for regulation

The organisations that signed on to the submission are not the only ones who think the time has come to rein in the BNPL industry.

In December, CHOICE asked over 6000 people about their experiences with BNPL products and their views on the industry.

“It’s simple, people are getting into more and more debt with this new method of buying items,” one respondent said. “It is still purchasing on credit and accordingly should be covered by the same legislation as credit cards.”

Another consumer told us: “Buy now, pay later products target and exploit the most vulnerable people in our community. It’s purely a business exercise for the companies involved. There is no reason why they should not be compelled by the same rules as banks, in order to protect vulnerable people.”

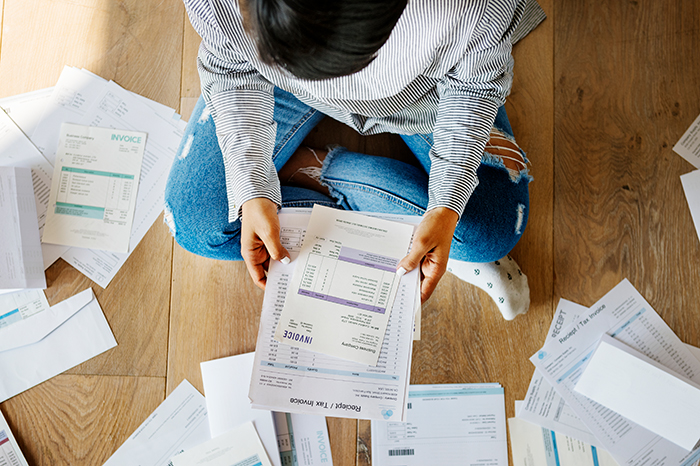

In nationally representative surveys conducted by CHOICE in June and September 2022, we found that a significant number of people are being sold into unaffordable BNPL debt:

- One in seven BNPL users were sold more than 20 loans in the past year

- One in five BNPL users have missed or been late with a payment

- Of those users with late payments, two in five have taken out another loan to pay for BNPL fees or debts

- One in four BNPL users accessed this credit product to pay for essential products or services.

Failing family violence victims

The BNPL industry can play into the hands of wrongdoers in sinister ways. In October last year, we reported on the growing trend of BNPL products being used as a tool of family violence and economic abuse.

“Now it’s not uncommon for us to see victim survivors of family violence and economic abuse present each week with buy now, pay later debts and issues,” a program manager at Westjustice’s Economic Justice Program told us.

It’s not uncommon for us to see victim survivors of family violence and economic abuse present each week with buy now, pay later debts and issues

Westjustice program manager

“Some will be debts incurred in their name by their ex-partners, and some are applications made by the victim-survivor themselves because they have otherwise been left in poverty after leaving the violent relationship.”

Paying later just to get by

For others, using BNPL to make ends meet can lead to further trouble.

“In terms of vulnerable people, we are seeing buy now, pay later used by people who are under pretty severe financial hardship, because there are no credit checks or the credit checks they do are pretty lax,” a financial counsellor at the Indigenous Consumer Assistance Network based in Cairns told us in 2021.

A senior policy officer at the Financial Rights Legal Centre told us buy now, pay later products can easily trigger a debt spiral from which escape can be difficult at best.

We are seeing buy now, pay later used by people who are under pretty severe financial hardship, because there are no credit checks or the credit checks they do are pretty lax

Financial counsellor, Indigenous Consumer Assistance Network

“You end up spending money you don’t have and your pay day comes around, and you end up spending most of your money on these repayments, and then you end up taking out more [BNPL] contracts.”

Facilitating long-term debt

Buy now, pay later providers make it easy to sign up to their platforms, asking for minimal personal details to open an account and making the whole process as ‘frictionless’ as possible. Many consumers are sold into multiple BNPL accounts and multiple purchases running concurrently on one account.

With credit products controlled by the Credit Act, such as credit cards and traditional personal loans, the regulations are there to prevent credit providers from selling people into unaffordable debt. That’s not the case with BNPL products. We’re calling on government to step in and regulate this fast-growing industry before more harm is done.