Get our independent lab tests, expert reviews and honest advice.

How to switch your health insurance

Health insurance premiums increased on 1 April, so it’s a good time to check that what you’re paying for health cover is justified by what you’re getting in return. It’s always worth comparing health insurance policies to see if you can get a better deal.

The Gold, Silver and Bronze system of health insurance introduced by the government in 2019 ranks policies by cover, but there’s no guarantee that a lower tier means a cheaper premium.

Make sure your policy isn’t a rip-off and that you have the right level of cover for your needs.

Review your health insurance

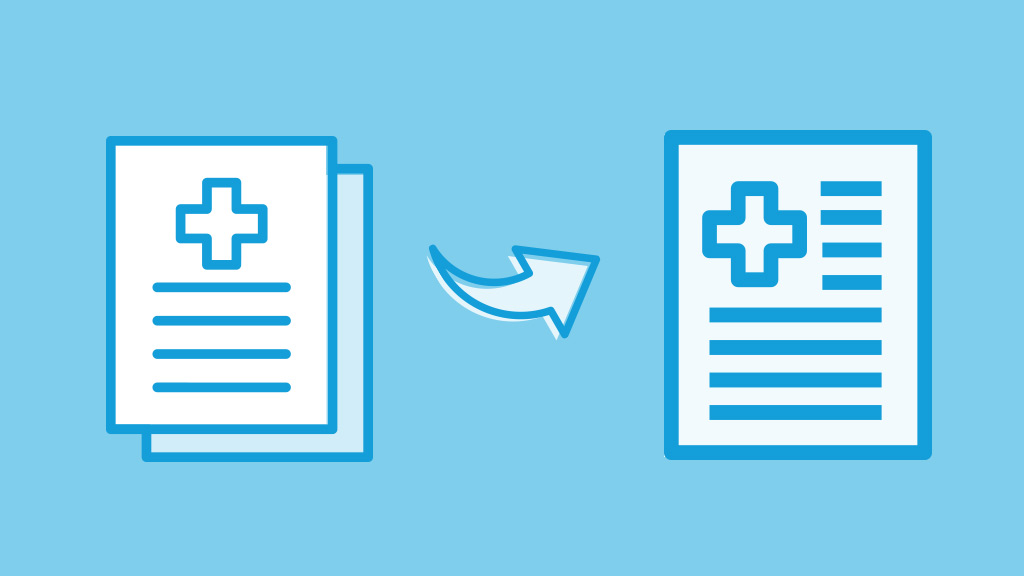

Health funds provide a fact sheet called the Private Health Information Statement (PHIS) for each policy, which allows you to compare your cover. You can review these at privatehealth.gov.au. Once you’ve found a better policy, here’s how to switch.

How do I switch health insurance funds?

1. Get a detailed quote from your new fund, including:

- Government rebate

- Lifetime health cover loading surcharge.

2. Apply for cover

- Ask for cover to start only when your old cover is cancelled.

3. From your old fund, request:

- Clearance certificate

- Itemised claims statement.

Make a copy and send to your new fund.

4. Cancel your old cover

- Cancel your direct debit with your fund and your bank.

5. Notify your new fund to start the cover

6. Check your bank statement to make sure:

- Your new cover has started

- Your old cover has been cancelled

- There is no overlap.

Enjoy your savings!

Read more at choice.com.au/health.

Main considerations when switching health insurance

Benefit limits

Check the benefit limits for specific services. They’re usually a fixed amount. Benefit limits are often listed as a dollar amount, but occasionally you may see a benefit limit listed as a percentage on the PHIS. This means the fund will give you that percentage of the actual cost of the service (for example, 50% of your dental bills). However, if you see a benefit listed as a percentage in a fund’s marketing material, it may mean something else, so always go by the PHIS.

Lifetime limits

Beware of lifetime limits (some funds have them for orthodontics) and combined annual limits for a range of services, such as $400 for physiotherapy, natural therapies and chiropractic. This means that once you’ve claimed $400 for physiotherapy (for example), you won’t receive anything for the other therapies during that 12-month period.

Extras

For extras cover, consider the services you use most, such as dental, and check the annual limit per person and per family. Sometimes the family limit is only twice the per-person limit, while with other policies it’s four times the per-person limit.

Discounts

Check for a discount – some funds provide a discount of up to 4% for paying by direct debit or by prepaying your annual premium.

Waiting periods

Before changing policies, check any waiting periods. For extras cover, they’re usually two months for most services, 12 months for major dental, and 36 months for hearing aids. Funds often waive the shorter waiting periods and may even waive all waiting periods if you’re switching from another fund.

Once you’ve had hospital cover for 12 months you generally don’t need to worry about waiting periods, as long as you change to a comparable policy. But if you change to a policy with a lower excess or higher cover, you’ll have to serve a waiting period of up to 12 months for the additional services covered or savings.

Loyalty bonuses

Some funds have loyalty bonuses that you’ll usually lose should you switch to a new fund, though you can always try negotiating with the new fund to maintain the bonus.

Should you downgrade your hospital cover?

Do you have hospital insurance to protect your Lifetime Health Cover (LHC) status so that you don’t need to pay a surcharge if you take it up later in life, or perhaps to avoid paying the Medicare levy surcharge (MLS)?

If you’re relatively healthy and your only reason for having hospital insurance relates to the LHC or MLS, you could opt for a cheap hospital cover policy and upgrade later, when you need it. Depending on your situation, our experts have crunched the numbers and worked out how you can pay the LHC loading and save money.

Should you cancel your extras cover?

Unlike with hospital cover, government carrots and sticks don’t apply to extras cover, so you can cancel it without any impact on your tax or without having to pay more if you wish to take it up again later. Here’s how to avoid bad value extras policies.