Get our independent lab tests, expert reviews and honest advice.

Financial counsellors sound the alarm about Afterpay Plus

Need to know

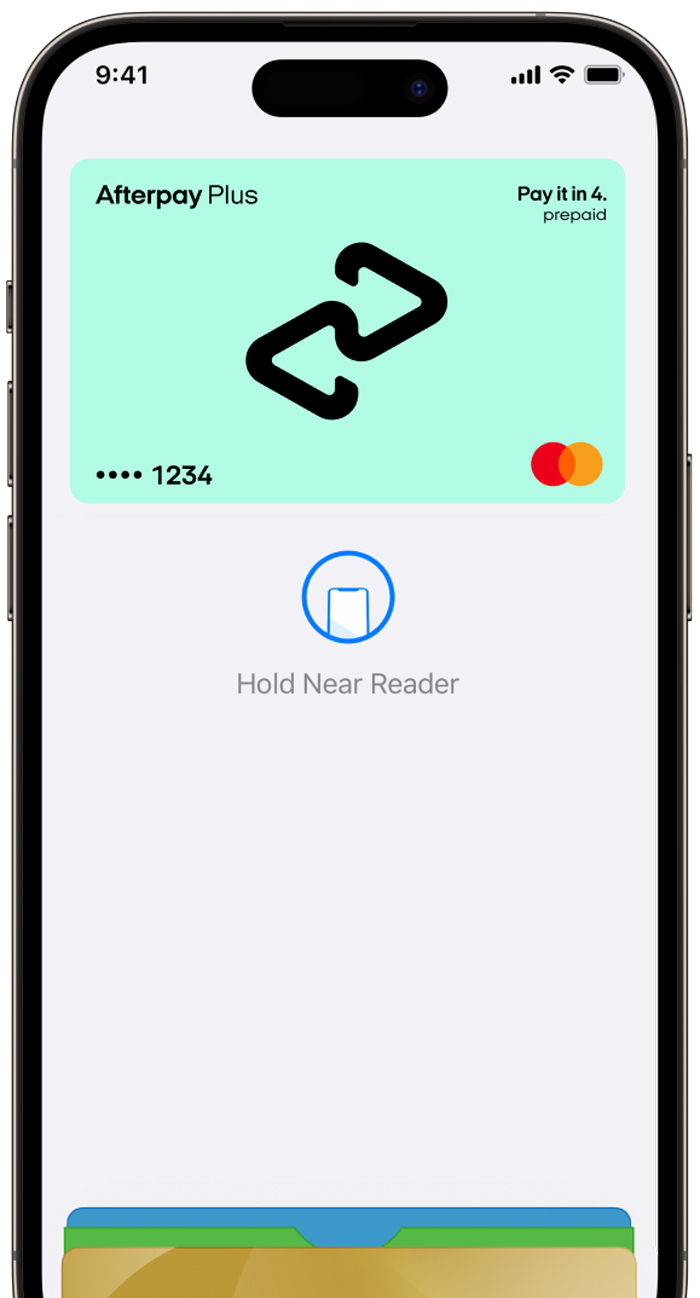

- Afterpay has launched a partnership with Apple Pay, Google Pay and Samsung Pay

- The paid subscription service Afterpay Plus allows you to instantly activate loans anywhere that mobile payments are accepted

- Financial counsellors and advocates are raising the alarm about the product and the fact that it deters customers from cancelling

Buy now, pay later (BNPL) services are marketed as handy tools for discretionary purchases, but more and more Australians are using these instant credit enablers for essentials such as food, electricity and medical expenses.

That’s one of the reasons why the poorly regulated BNPL sector has been an area of increasing concern for consumer advocacy groups, including CHOICE.

Now, Australia’s biggest buy now, pay later company, Afterpay, has launched a new paid subscription service that may make matters worse for consumers in financial straits.

What is Afterpay Plus?

The new offering, called Afterpay Plus, costs $10 a month and links your Afterpay account with your Apple Pay, Google Pay or Samsung Pay account.

It means that shoppers using one of these payment services, which are accepted at almost all major retailers and supermarkets, can instantly activate an Afterpay loan with limited checks on whether the Afterpay purchase is appropriate for their financial circumstances, and no oversight over whether the user is paying for essentials rather than discretionary items.

Financial counsellors see the new product as a sign that BNPL is continuing to spread through all sectors of the economy.

Afterpay Plus was soft-launched in August this year but is currently available on an “invitation-only basis”. Afterpay tells CHOICE that the product will be more widely available later this year.

CHOICE has spoken to several Afterpay users who use the app infrequently and say they haven’t received an invitation to join Afterpay Plus.

“Based on our research, we estimate initial Afterpay Plus Card uptake will be driven by a small cohort of our most engaged customer base in Australia,” an Afterpay spokesperson says.

What are the problems with Afterpay Plus?

1. Making loans too easily accessible

Fiona Guthrie, CEO of Financial Counselling Australia, says Afterpay Plus is a concern for financial counsellors, who are increasingly seeing people get into trouble with BNPL loans.

People don’t think of it as credit, generally, but you’re using someone else’s money

Financial Counselling Australian CEO Fiona Guthrie

“You’ll just be able to use your Afterpay Plus card because it’s just tap and go and I guess the more seamless it becomes, the less people kind of stop and think about it as a product and taking out a loan. People don’t think of it as credit, generally, but you’re using someone else’s money,” she says.

Andy Kelly, CHOICE head of campaigns and mobilisation agrees that seamlessly combining Afterpay with widely used instant payment platforms is a concern.

Afterpay Plus takes poorly regulated loans, combines it with a costly subscription model, and allows people to sign up for a new loan just by swiping their phone at the checkout.”

CHOICE head of campaigns and mobilisation Andy Kelly

“BNPL loans are still poorly regulated and don’t come with the same consumer protections as other forms of credit, such as requiring lenders to conduct safe lending checks and to have good financial hardship policies for people doing it tough,” he says. “Afterpay Plus takes poorly regulated loans, combines it with a costly subscription model, and allows people to sign up for a new loan just by swiping their phone at the checkout.”

2. Dodging regulation and deterring people from cancelling

The company also stipulates that people who unsubscribe from Afterpay Plus will be banned from using the product for 12 months and encourages users to pause their subscription instead. If you unsubscribe, you can still use your regular Afterpay account, but will be banned from using Afterpay Plus, which Kelly says is disappointing.

“Banning people from signing back up to the service for 12 months could deter people from cancelling the subscription altogether,” Kelly says.

Afterpay says the 12-month break is “in alignment with the current BNPL regulatory framework and its requirements”.

However Tom Abourizk from Consumer Action Law Centre says that it appears the 12-month break is actually imposed to ensure that Afterpay Plus continues to avoid regulation as a credit product.

We have been telling Afterpay for years that we are seeing people use their product to pay for essentials … they have made this even easier with Afterpay Plus

Tom Abourizk, Consumer Action Law Centre

“Like all BNPL products, Afterpay Plus is designed to fall within an exemption to the definition of credit. Under this loophole, a provider can only charge fees on one credit contract within 12 months,” he explains.

“We have been telling Afterpay for years that we are seeing people use their product to pay for essentials. It is concerning that they have made this even easier with Afterpay Plus, while still going to lengths to avoid the consumer safeguards in the credit law.”

BNPL loans leading to debt traps

Sally Jungwirth is a financial counsellor with the Consumer Action Law Centre working on the National Debt Helpline. She says she has seen a number of clients who prioritise paying debts to BNPL providers ahead of other, costlier loans or even their mortgage.

These are people who aren’t able to access conventional credit because they wouldn’t meet the responsible lending criteria, so they turn to BNPL

Sally Jungwirth, Consumer Action Law Centre

“A lot of clients don’t know about alternatives like no-interest loans. You know, these are people who aren’t able to access conventional credit because they wouldn’t meet the responsible lending criteria, so they turn to BNPL,” she says.

One recent client of Jungwirth’s, who asked not to be named, took out a high-interest loan from Cash Converters to pay off her Afterpay debt. The Cash Converters loan has left her in a deeper debt that she is struggling to repay.

Time to close the legal loopholes

In May, the federal government announced long-awaited reforms to the BNPL sector, saying that companies would be brought under the Credit Act and that responsible lending and hardship arrangements would be mandated.

But the details of the reforms are yet to be confirmed and some have expressed concerns that concessions to the industry could harm consumers.

Kelly says Afterpay has exploited gaps in Australia’s consumer laws over a number of years and the new product suggests they have no intention of changing course.

Afterpay has exploited gaps in Australia’s consumer laws over a number of years and the new product suggests they have no intention of changing course

“This new product only proves that they’ll continue to exploit loopholes until the loopholes are closed. It’s crucial that any new regulations to rein in buy now, pay later providers include safe lending obligations, including a requirement to verify income before approving a loan,” he adds.

If you need help managing debts or bills, call the National Debt Helpline on 1800 007 007 for free, confidential and independent information and advice.