Get our independent lab tests, expert reviews and honest advice.

Banks announce new anti-scam initiatives

Need to know

- The main measure being introduced is a confirmation-of-payee system aimed at preventing bank transfer scams

- Experts welcome the move but say banks should also have to reimburse customers for scam losses

- Telcos and digital platforms must also act to protect customers from scams

They’re a modern-day scourge that cost Australians dearly and each year the harm grows. Earlier this year, the ACCC reported that Australians lost a staggering $3.1 billion to scams in 2022, an increase of 80% on the previous year.

As the losses mount, CHOICE has been calling for stronger protections, saying that businesses must do more both to stop people from being scammed in the first place and to help those who are affected.

A recent announcement from the banking sector could be an important first step in protecting customers.

Confirmation-of-payee system to prevent bank transfer scams

Reporting by ASIC based on the 2022 financial year found that the big four banks only detected and stopped 13% of scam payments made by customers, but a new system announced recently may help to change that.

Last week, the Australian Banking Association and Customer Owned Banking Association launched a new Scam-Safe Accord, an agreement between Australia’s banks, building societies and credit unions.

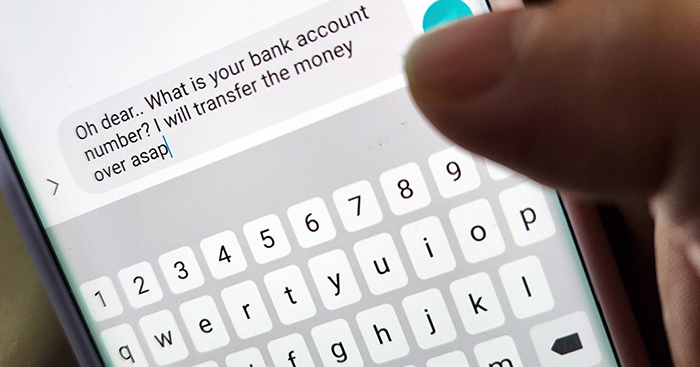

The accord includes a range of initiatives, but its central measure is a confirmation-of-payee system, designed to protect Australians from fraudulent bank transfers, a scam that netted criminals more than $210 million in 2022.

Its central measure is a confirmation-of-payee system, designed to protect Australians from fraudulent bank transfers

Under the system, when customers set up a payment to a new account, they will receive a message from their bank indicating whether or not the bank account details entered match the name of the account they’re sending money to. Consumers are told if the details are a ‘close match’ or not a match at all and are advised to check before proceeding.

Experts have been calling for this kind of system for years. In July 2022 the Australian Competition and Consumer Commission (ACCC) said the banking sector should establish an industry-wide account name checking system. The UK introduced it in 2019 and Dutch banks began an IBAN-name check service in 2017.

Other anti-scam measures

As well as the confirmation-of-payee system, the Scam-Safe Accord also promises to:

- make it harder for scammers to set up and use fraudulent accounts

- increase the sharing of intelligence and data across the banking industry

- create limits on transfers to the most high-risk channels, such as certain cryptocurrency platforms

- introduce delays and warnings for some payments.

In response to the announcement a spokesperson for the ACCC told us: “The National Anti-Scam Centre welcomes the initiatives represented in the accord and in particular the commitment to implement confirmation of payee.”

“The initiative represents a good first step in relation to some of the issues that ecosystem rules and codes will need to address, to effectively protect consumers from scams. We look forward to working with financial intuitions, telcos and platforms on these important obligations.”

More needs to be done

CHOICE was among those who welcomed the move but we believe more needs to be done.

“Consumer advocates have been calling for the banking industry to do more to protect people from scams for years. CHOICE welcomes the long overdue joint commitments to implement consumer protections against scams, particularly confirmation of payee measures,” says Yelena Nam, CHOICE campaigns and policy advisor.

Scammers will continue to adapt and find vulnerabilities, so it’s crucial that banks are required to reimburse consumers for scam losses

Yelena Nam, CHOICE campaigns and policy advisor

“We know scams are becoming more sophisticated, with 88% of people in Australia agreeing that scams have become harder to spot recently,” she adds.

“While the banking industry’s commitments are a good step forward, scammers will continue to adapt and find vulnerabilities, so it’s crucial that banks are required to reimburse consumers for scam losses.

“This will incentivise the banks to continue to adapt to evolving scam threats.”

Other advocates agree.

“The critical next step must be for the government to introduce mandatory reimbursement of customers’ money still lost to scams. There needs to be a clear, high standard of care that banks are required to meet at law, and if they fail to do so, the bank should foot the bill,” said Consumer Action Law Centre CEO Stephanie Tonkin.

This sentiment reflects data from CHOICE research released earlier this year. Our June 2023 survey found that 64% of Australians believe banks should be required to reimburse scam victims.

Other industries must step up

It isn’t just the banking industry that needs to act to stop scams.

“All other industries that play a role in enabling scams, like digital platforms and telcos, should also be required by the government to meet strong consumer protections against scams,” says Nam.

“The government has the support of 80% of people in Australia for requiring businesses to do more to protect people from scams.

In September this year, CHOICE released research that showed 66% of Australians believe digital platforms such as Google and Meta, aren’t doing enough to protect people from scams.