Get our independent lab tests, expert reviews and honest advice.

5 tax scams to watch out for this year

Need to know

- Australians are being warned to expect a "deluge" of scams in the lead-up to the new financial year

- Most tax-time scams involve criminals impersonating tax office or government officials in attempts to get your money or information

- There are five types of scams worth looking out for this year, each with their own red flags

On this page:

- 1. Promising refunds

- 2. Dodgy money-making opportunities

- 3. Requests for information

- 4. Demanding debts

- 5. Fees for free services

- How to report a tax scam

Tax time is a prime season for scammers.

It’s a period where we’re often rushing to get our affairs in order or waiting to hear from the government about refunds we’ll receive or debts we’ll have to pay.

Criminals know this and are poised to tap into any financial anxiety we might have, ready with tech solutions that allow them to pose as tax officials or government agents promising returns or demanding debts.

The Australian Tax Office (ATO) regularly sees scammers impersonating its staff in attempts to steal from others, recently noting that reports of ATO impersonation emails had jumped by 300% in the year to June 2025.

Scam activity is only expected to ramp up from now on, with national accounting body CPA Australia saying we “should prepare for a deluge of scam activity” in the lead-up to June 30.

With many tax scams becoming harder to spot, we’ve trawled through the most common types to bring you an outline of the five recurring cons scammers are likely to deploy in the coming months.

1. Promising refunds

With the current cost-of-living pressures, many of us would happily welcome news of a tax refund.

But offering a refund in order to draw us into handing over our money and personal information is a favourite ploy of tax time scammers.

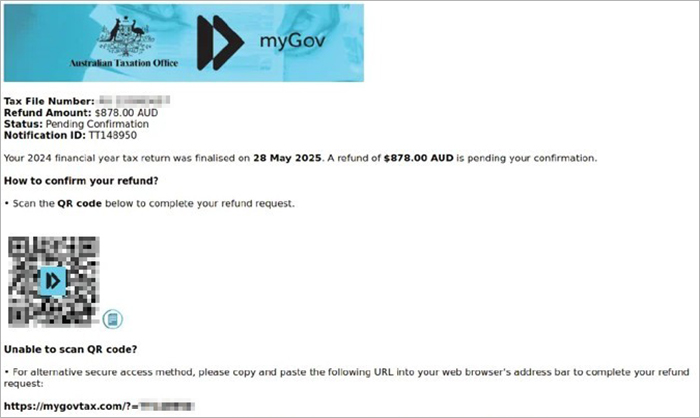

In one of its latest warnings, cyber security company MailGuard revealed it’s been intercepting suspicious emails claiming to come from the ATO employing this method.

The emails use tax office branding and tell recipients they’re eligible for a refund of almost $900.

The messages come with a link and QR code, both of which lead to a fake copy of the ATO’s website.

MailGuard says users navigating to this page are prompted to enter their credit card details in order to receive their refund.

Doing this won’t secure you a refund, rather it allows the scammers to harvest your card details for their own use.

Emails or SMS messages claiming to come from the ATO or online government service hub myGov that say you’re eligible for a tax refund are one of the most common hallmarks of a tax scam.

These messages usually come with links to click on or QR codes to scan which lead to websites designed to collect your bank, card or other sensitive details.

More and more scammers have been using QR codes in particular to phish for this information – to learn why, see our ‘quishing’ investigation.

How to spot them

QR codes might be common in other parts of daily life, but neither the ATO nor myGov will ever send you one to log in to their online services.

They’ll also never send you unsolicited links to click on via SMS or email.

2. Dodgy money-making opportunities

In one of its latest warnings to Australians, the ATO has sounded the alarm on a rise in schemes claiming to help people reduce their tax or avoid paying any whatsoever.

The tax office says these unlawful operations are often sold as investment opportunities. In one, individuals are told to put money into a start-up in order to be able to claim an investor tax offset.

In another of these schemes being promoted on social media, people are told they can avoid paying tax by setting up a purported non-profit foundation and diverting their income to it.

The ATO has described many of these initiatives as unlawful and ineffective, saying they won’t let you get away with not paying income tax.

Its warning has been followed by another from ANZ, which says it expects investment scams to become more common after the Reserve Bank shook up Australia’s money market earlier this year by making multiple cuts to interest rates.

ANZ says criminals could target Australians reconsidering their investments or deposits in the wake of these decisions, posing as financial institutions or advisers and pushing deceitful money-making schemes.

How to spot them

Have you been approached by someone promising a tax scheme that sounds too good to be true? The ATO recommends seeking advice on any arrangements from a registered tax practitioner.

Check if a practitioner is registered by using the Tax Practitioners Board’s public register.

You can report illegal tax schemes to the ATO via its online tip-off form.

Other investment scams tend to stand out for promising returns too good to be true, urging you to get involved quickly or promoting themselves via ads on social media with photos or videos of well-known celebrities (often fake).

3. Requests for information

According to the ATO, another recent scam doing the rounds involves criminals trying to steal sensitive details using a classic technique.

It features emails claiming to come from the tax office or myGov that urge recipients to reply with their personal information, including their Tax File Number (TFN), driver’s licence number and Medicare details.

The emails are made all the more appealing by promising compensation following a “recalculation” of your taxable income and appearing to come from a legitimate-looking ATO address.

Criminals have also been known to include these sorts of appeals for personal information in ATO or myGov-branded emails that carry links to fake copies of the myGov website designed to collect personal information.

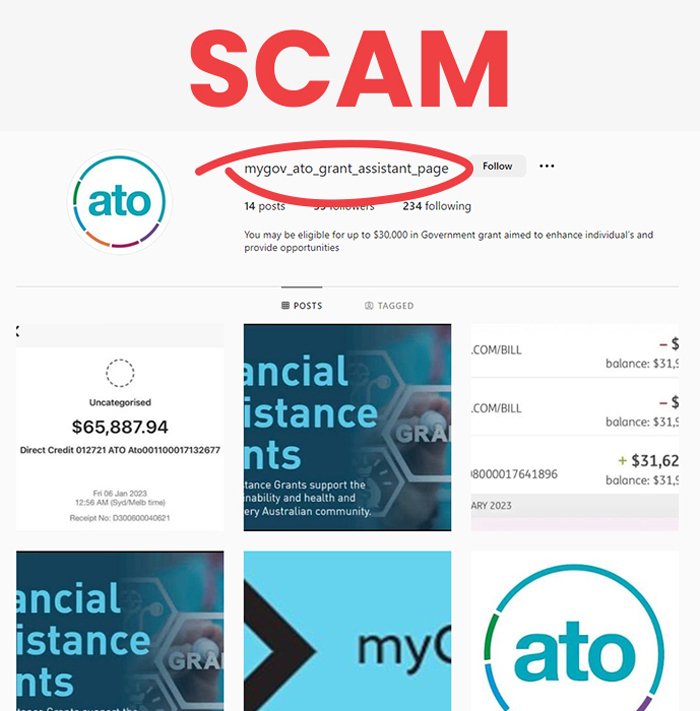

Another favourite method among scammers is to set up fake ATO or myGov accounts on social media sites such as Instagram or X and use these to respond to people looking for help from government services on these platforms.

The fake accounts will claim to be able to assist and invite the victim to chat via direct message, where they’ll be asked for sensitive details or sent links to malicious sites built to harvest valuable information.

The ATO warns that once they have details like your TFN or payslips, scammers can steal your superannuation or commit tax refund fraud in your name.

As we’ve highlighted in the past, scammers can also use sensitive details such as these down the track in more sophisticated and devastating cons, such as phone porting or SIM swap scams.

How to spot them

The ATO will never send you an unsolicited message asking you to provide sensitive personal information over SMS or email.

As mentioned previously, it won’t send you links via SMS, email or social media to log in to online services like myGov or ask you to provide any personal information through these channels.

The ATO is active on Facebook, Instagram, LinkedIn and X, but will never use these platforms to discuss your personal information or ask you for documentation or payments.

You can spot phishing attempts on social media by taking a closer look at the accounts purporting to be the ATO.

Most of the organisation’s official profiles have tens of thousands of followers and have been active for up to 10 years, so steer clear of any ATO-affiliated account that doesn’t have many followers and was only created recently.

4. Demanding debts

Just as scammers will exploit our appetite for a refund, they’ll also take advantage of the fact that the ATO will sometimes request money from us.

In a classic case, scammers impersonating tax officers may contact you by phone or SMS, claiming you haven’t paid enough tax and demanding you pay them immediately to cover the shortfall.

To get you to act quickly, they might also claim that a warrant will be issued for your arrest unless you pay right away.

Scammers have also been known to claim that your Tax File Number (TFN) has been suspended due to illegal activity and that you’ll need to make a payment to avoid being arrested or to protect your TFN.

How to spot them

The ATO doesn’t suspend TFNs and will never threaten you with immediate arrest or demand you stay on the phone until a payment is made, so anyone employing these tactics is a criminal.

The ATO will also never make you pay with gift cards, vouchers or cryptocurrency or ask you to transfer money to a personal bank account to settle a tax debt.

If you’re not sure if a call is really coming from the ATO, call them back on 1800 008 540 to verify anything you’ve been told.

The tax office does use an external debt collection agency, Recoveriescorp.

The ATO says this agency may contact you if you’ve been referred to them. If you’re not sure whether it’s really Recoveriescorp, phone them directly on 1300 323 495 to check.

5. Fees for free services

Con artists passing themselves off as being from the tax office may also offer services (for a price) which are actually available from the ATO for free.

For example, ads offering to help you get a TFN for a fee have been known to circulate on social media. In reality, these posts direct victims to websites built to steal money or personal information.

How to spot them

Applying for a TFN is free and can be done through the official ATO website.

If you’re applying for one through a tax agent, check that they’re registered with the Tax Practitioners Board.

5 types of tax scam to be aware of

1. Promising refunds

2. Dodgy money-making opportunities

3. Requests for information

4. Demanding debts

5. Fees for free services

How to report a tax scam

If you receive suspicious communication from the ATO, don’t give away any information, click any links, scan any codes, download software or open any attachments.

Call the ATO directly on 1800 008 540 to double-check what you’re being told.

If you’ve encountered a scam, report it to the ATO by emailing screenshots of social media posts and accounts or SMS messages to reportscams@ato.gov.au. You can also forward suspicious emails to the same address.

If you’ve given money or personal information to a scammer, contact the ATO on 1800 008 540. Also report these incidents to your financial institution, IDCare and to police via ReportCyber.

If you’ve encountered a myGov-related scam, call Services Australia on 1800 941 126.

For more on what to do in this situation, read our guide to the five things to do if you’ve been scammed.