Get our independent lab tests, expert reviews and honest advice.

Home insurance cover for bushfires

Need to know

- All home insurance policies offer cover for house fires and bushfire, but you should make sure your home and belongings are insured for the right amount

- Take into account extra costs, including demolition, debris removal and compliance with modern building codes

- Some insurance policies have a safety net in case building costs increase after a major natural disaster

On this page:

- Does your insurance cover bushfire?

- Protecting yourself from underinsurance

- Consider a safety net or total replacement policy

- Don't forget about extra costs

- After a bushfire

- Preparing your insurance for bushfire season

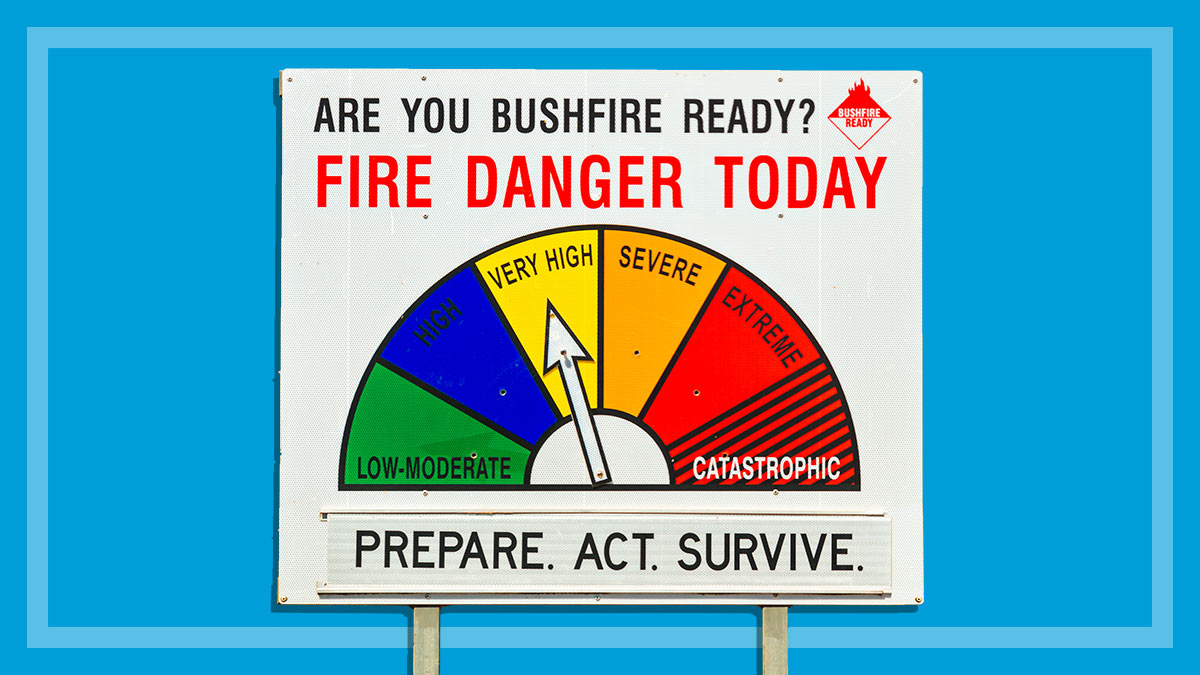

The outlook for this summer is pretty frightening. According to the Bureau of Meteorology, Australia is facing one of the hottest summers on record with above-average rainfall, storms and possibly an active cyclone season.

The hot temperatures mean a high risk of bushfires, especially for drought-affected regions in southern SA and Victoria. And the wet ground in many other regions in the past few years has supported the enhanced growth of vegetation, which means there’s also a higher risk of fires this season.

Your local rural fire service has information on preparing your property for fire, but we can help you make sure you aren’t left high and dry financially if a bushfire hits your home.

Does your insurance cover bushfire?

Home and contents insurance

All home insurance policies we compare (and that’s most of them on the market) offer fire insurance cover for house fires and fires caused by bushfires. This means you’ll be covered up to your sum insured if your house or apartment is damaged or destroyed by a fire, including any damage caused by soot, ash and smoke from a fire close to you.

Car insurance

If you have comprehensive car insurance or third-party fire and theft cover for your car, it will be covered if it’s damaged or destroyed by fire, including a bushfire. But beware: if you only have third-party cover, your car is not covered in the event of a fire.

Pet insurance

Some home and contents insurance policies cover vet bills if your cat or dog is injured, either due to an insured event like a fire or an accident. Depending on your policy, you can claim between $500 and $2000 for vet bills for your pets. Some companies offer this cover as an optional extra, so if you want it, check with your insurer. Some insurers that automatically include fire cover might do so for their top-tier products only.

Alternatively, if you have a pet insurance policy with injury cover, it will cover your cat or dog for burn injuries and smoke inhalation.

Protecting yourself from underinsurance

Underinsurance is when the amount you insure your property for isn’t enough to replace it, leaving you out of pocket or settling for a cheaper alternative. The best way to prevent underinsurance is to make sure your home and contents sum insured values are up to date.

Most insurers have a calculator you can use to estimate the replacement value of your property. You could also ask a builder for an estimate.

The best way to prevent underinsurance is to make sure your home and contents sum insured values are up to date

But it shouldn’t just be up to you! Insurers can and should be doing more to help you keep your sum insured amount up to date.

“Companies should be required to proactively warn consumers if they think they’re potentially underinsured. This warning should be built into the purchase journey,” says CHOICE head of policy Tom Abourizk.

CHOICE wants insurers to warn consumers that they are potentially underinsured both when they first take out insurance and when renewing. Renewal notices should also show the insurer’s calculations and reasons for any changes so that consumers can understand why there is an underinsurance warning.

Take action: Sign the petition for fair and affordable insurance.

Consider a safety net or total replacement policy

Many insurers offer an underinsurance safety net for building cover. Depending on the size of the safety net, you could claim up to 30% above your sum insured if the cost of rebuilding your home escalates. This can be useful if rebuilding costs go up in the wake of a natural disaster.

The following insurers offer safety net policies for home insurance:

- AAMI Complete Replacement Cover – total building replacement (optional)

- Australia Post – 30%

- GIO Platinum – 30%

- Kogan – 30%

- QBE – 30%

- Suncorp Classic Advantages – 30%

- TIO – 30%

- ANZ – 25%

- Bankwest – 25%

- CBA – 25%

- GIO Classic – 25% (optional)

- GIO Classic Extras – 25%

- NRMA Home Plus – 25%

- Suncorp Classic – 25% (optional)

- Suncorp Classic Extras – 25%

- Budget Direct – 20%

- ING – 20%

- Qantas – 20%

- Virgin Money – 20%

- AAMI – 10% (without optional complete replacement cover)

- RAA – 10%.

One step above the safety net is a total replacement policy option, which AAMI offers. Instead of setting a sum insured, the insurer commits to restoring your building regardless of the cost – although these policies aren’t always cheap, and a larger or better-built home will still cost more to insure

A few insurers also have a safety net for your contents, although these are not as generous, with a maximum of 25% above the sum insured. They include:

- Bankwest – 25%

- CBA – 25%

- NRMA Home Plus – 25% (ACT, NSW, Vic, Tas, Qld)

- RAA – 10%.

Don’t forget about extra costs

Additional expenses such as demolition, debris removal, architect fees and the costs of complying with local regulations and alternative accommodation are usually included in home insurance policies – you might be able to claim a dollar amount or a percentage of your building sum insured to cover these.

While many insurers cover removal of debris and accommodation on top of the sum insured, cover for other extra costs usually comes out of your sum insured amount. Have a look at your product disclosure statement (PDS) or our home and contents insurance review to see how your insurer handles them, and adjust your sum insured if you need to.

Modern building codes increase rebuild costs for at-risk properties

If you live in an older home in a fire risk zone, it might cost more to rebuild. This is because a replacement house will need to conform with new fire safety rules, introduced to the national building code after the 2009 Black Saturday fires in Victoria. Building a compliant home in the highest risk locations could add hundreds of thousands of dollars to the bill.

Make sure you know what your property’s Bushfire Attack Level (or BAL) is and speak to your insurer or a builder about how this affects your house’s rebuild cost

Beware waiting periods

Many home insurers impose short waiting periods on cover for natural disasters such as bushfires, cyclones and floods. Waiting periods are usually 48–72 hours. They apply if you weren’t previously insured, are upgrading your cover, or increasing your sum insured. The idea is to prevent people from staying uninsured until there’s smoke on the horizon.

For example, if your policy has waiting periods and you increase your sum insured from $500,000 to $550,000, that extra $50,000 won’t apply to bushfire cover until the waiting period ends.

Know your definitions

CHOICE investigated home and contents policies in the wake of the 2019/2020 bushfires and found 70% of the policies analysed contained confusing, unfair or unclear fire definitions. Some policies excluded damage from “heat, soot, smoke or ash”, others set unfair limits on the distance of a fire from a property and some failed to adequately define ‘fire’ at all.

After a campaign led by CHOICE, in which we contacted insurers directly with a petition signed by 47,000 supporters, Treasury released a consultation paper into standardising natural hazard definitions earlier this year. But, while there have been improvements, it still pays to scrutinise your policy for any vague terminology.

Gardens and garden furniture

While your house is usually covered in the event of a bushfire, the cover for your garden and outdoor furniture can be very limited.

Garden cover is usually limited or there is no cover at all. And while your outdoor furniture may be covered against theft, it may not be covered against fire. Many policies also don’t cover you for scorching and melting if there is no flame.

After a bushfire

When you contact your home insurer after a house fire or bushfire, they’ll send someone to assess the extent of the fire damage. Once your property is safe, take photos of all damaged belongings and buildings, as this will help the insurer process your claim.

Prevent further loss by covering exposed contents with a tarp or putting them under shelter. Don’t throw away any items unless they’re hazards.

If your home is declared a total loss (i.e. it needs to be pulled down and rebuilt), your fire insurance will organise to have it rebuilt, or you can choose to receive your full sum insured as a cash settlement.

But there are a number of traps with cash settlements. It’s very important not to sign anything before you’ve had time to consider the cash offer properly. If the damage is significant, you may also want to get legal and financial advice.

As for home contents fire insurance, some insurers offer store credit at one of their preferred suppliers, instead of a cash settlement, to replace damaged items.

Many insurers we’ve compared let you nominate your own builder for a rebuild after fire, but they might retain the right to refuse if the quote is too high.

Your fire insurance includes cover for accommodation if your home is uninhabitable after a fire. Depending on how long you need to be away from your home, this might be hotel accommodation or a longer term rental home similar to your own. Additionally, insurers usually cover storage costs for undamaged contents, if they can’t be stored at your home or temporary accommodation.

Depending on the policy, the amount you can claim will be 10–20% of your building sum insured, 12–24 months’ rent for an equivalent property, or whichever is less.

State and federal governments also give financial assistance to people affected by natural disasters such as bushfires.

Some insurers also include $500–2000 cover to replace refrigerated food and medication that spoils. You might also be able to claim this if your power cuts out, even if your property isn’t directly affected by bushfire.

Who chooses the repairer?

That depends on your insurer. Many insurers we review let you nominate your own, but they might retain the right to refuse if the quote is too high.

Keep in mind that insurers have commercial relationships with builders and get cheaper rates than the rest of us. This means that if you take a cash settlement for a partially damaged building, your insurer might only offer you what it would cost them to repair your home, potentially leaving you out of pocket. Get your own quotes before choosing to go down this path.

Preparing your insurance for bushfire season

- Assess whether your sum insured is still enough to replace your home and all your contents. Treat your insurer’s calculator as a guide only, and consider getting an estimate from a builder.

- Find out what extra costs might apply if you have to rebuild.

- Keep a copy of your insurance documents in your evacuation bag.

- Upload photos of your belongings and scans of receipts to a cloud storage service to keep them safe.